Right Now

Fully Enclosed 3D Printing Smart Warehouse Market: Market Dynamics and Strategies for Success 2025-2031 | Survey by QYResearch

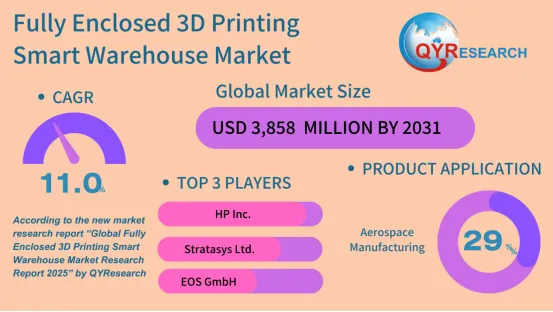

Global Fully Enclosed 3D Printing Smart Warehouse Market to Grow at 11.0% CAGR Through 2031

The global market for Fully Enclosed 3D Printing Smart Warehouses, valued at USD 1,856 million in 2024, is projected to grow to USD 3,858 million by 2031, expanding at a compound annual growth rate (CAGR) of 11.0% over the forecast period. This growth is fueled by increasing demand across key industries such as aerospace, automotive, medical, and manufacturing, according to the 2025 Global Market Research Report by QYResearch.

Key Players Driving Innovation

Leading companies in the sector include:

HP Inc.

Stratasys Ltd.

3D Systems Corporation

EOS GmbH

GE Additive

Renishaw plc

Materialise NV

SLM Solutions Group AG

Trumpf GmbH + Co. KG

BASF Forward AM

Siemens AG

Voxeljet AG

Arcam AB

Prodways Group

Additive Industries

In 2025, GE Additive introduced a next-generation smart warehouse system integrating AI-driven print path optimization and real-time defect correction within a fully enclosed environment. This innovation reflects a broader trend across the industry towards integrating artificial intelligence and automation into additive manufacturing workflows.

Company Product Models and Specifications

1. HP Inc.

Jet Fusion 5200 Series

Jet Fusion 4200 Series

Jet Fusion 540/580 Color Series

Metal Jet S100

2. Stratasys Ltd.

F900

F770

J850 Pro

Origin One

Neo800

3. 3D Systems Corporation

Figure 4 Standalone

ProJet MJP 2500

ProX DMP 320

SLA 750

4. EOS GmbH

EOS M 290

EOS P 500

EOSINT M 280

5. GE Additive

Concept Laser M2 Series 5

Arcam EBM Spectra L

Binder Jet Line Series 3

6. Renishaw plc

RenAM 500Q

RenAM 500E

7. Materialise NV

Magics Software Suite

Streamics

Build Processors

8. SLM Solutions Group AG

SLM 125

SLM 280 2.0

NXG XII 600

9. Trumpf GmbH + Co. KG

TruPrint 1000

TruPrint 3000

TruPrint 5000

10. BASF Forward AM

Ultrafuse 316L

Ultrafuse PLA

Ultrafuse TPC

11. Siemens AG

NX Additive Manufacturing

Teamcenter Integration

Simcenter AM Simulations

12. Voxeljet AG

VX1000

VX2000

VX4000

13. Arcam AB (GE Additive)

Spectra H

Spectra L

14. Prodways Group

ProMaker LD10

ProMaker P1000 X

ProMaker L5000

Applications Fueling Growth

Key applications for these intelligent systems include:

Aerospace Manufacturing

Automotive Parts Production

Medical Device and Implant Manufacturing

Industrial Molds and Prototyping

Other customized manufacturing operations

Product Segmentation

The market is segmented by warehouse type:

Fully Enclosed Metal Printing Smart Warehouse

Fully Enclosed Plastic Printing Smart Warehouse

Fully Enclosed Multi-material Composite Printing Smart Warehouse

Fully Enclosed Stereolithography Printing Smart Warehouse

Other formats including hybrid and niche materials

2025 Market Trends and Strategic Impacts

As we move through 2025, the fully enclosed 3D printing smart warehouse market continues to evolve rapidly. Several macro and technology-driven trends are reshaping the strategic landscape across North America, Europe, and Asia-Pacific. Below is a comprehensive review of the most influential dynamics and data-supported developments.

1. Reshoring and Nearshoring Production

In response to growing geopolitical risks and global supply chain disruptions, manufacturers are increasingly investing in reshoring and nearshoring strategies. According to a 2025 survey by Reshoring Initiative, more than 60% of U.S.-based industrial manufacturers have either reshored production or have nearshoring plans under development. This trend is particularly pronounced in industries relying on precision manufacturing and rapid part availability, such as aerospace and medical devices.

Europe is witnessing similar patterns. German companies like Siemens and Trumpf are repatriating additive manufacturing operations to enhance quality control and reduce lead times. The EU’s strategic autonomy framework also provides subsidies for local production facilities in key sectors including advanced manufacturing.

2. AI Integration and Predictive Logistics

Artificial intelligence (AI) is playing a transformative role in 3D printing smart warehouses. From dynamic print queue optimization to real-time failure detection using computer vision, AI reduces downtime and increases equipment longevity. In 2025, companies like HP and GE Additive have launched AI-enhanced monitoring systems capable of adjusting print parameters on the fly to avoid material waste and ensure part accuracy.

On the logistics side, AI is helping warehouses predict order spikes, manage stock levels, and reroute supply lines in response to disruptions. According to a Gartner forecast, AI-enabled smart logistics will increase warehouse efficiency by up to 40% in high-volume production hubs by the end of 2025.

3. Sustainability and Material Efficiency

Environmental sustainability has become a top priority across the additive manufacturing industry. Leading firms such as BASF Forward AM and Stratasys are introducing new bio-based and recyclable materials specifically designed for enclosed smart printing environments. In 2025, the use of renewable materials in additive manufacturing has increased by 27% globally compared to 2023.

Fully enclosed 3D printing systems reduce emissions and contamination risks, making them well-suited for clean manufacturing environments. With stricter ESG reporting requirements in Europe and parts of North America, sustainability practices now directly influence investment decisions and supplier selection.

4. Tariff Uncertainties and Regional Diversification

Ongoing tariff uncertainties—especially in U.S. policy under the 2025 revision of the China trade act—are pushing companies to diversify production bases. U.S.-based 3D Systems Corporation, for example, has expanded operations into Vietnam and Mexico, while EOS GmbH is ramping up capacity in Eastern Europe to serve both EU and non-EU markets efficiently.

This diversification allows firms to avoid tariffs while enhancing regional responsiveness. Analysts expect that by the end of 2025, more than 30% of global 3D printing supply chains will involve multi-region fulfillment centers leveraging smart warehouse infrastructure.

5. Regional Leaders: North America and Asia-Pacific

North America remains the largest and most advanced market for fully enclosed 3D printing smart warehousing. Federal investments in manufacturing innovation hubs and workforce reskilling are boosting adoption. In 2025, U.S. smart warehouse investment is forecast to exceed USD 6.5 billion—up 19% year-over-year.

Asia-Pacific is equally dynamic, led by China, South Korea, and Japan. China’s 14th Five-Year Plan includes additive manufacturing as a strategic pillar, with over 500 new smart warehouse installations projected for 2025. Korean firms like Samsung and LG are incorporating enclosed 3D printers for rapid prototyping and production tooling directly within their logistics centers.

Conclusion

In 2025, the Fully Enclosed 3D Printing Smart Warehouse sector is more than a trend—it is a cornerstone of next-generation manufacturing. Reshoring, AI-driven logistics, sustainability, and regional diversification are converging to build a more resilient, responsive, and efficient global supply ecosystem.

Related Reports:

Global Fully Enclosed 3D Printing Smart Warehouse Market Research Report 2025

https://www.qyresearch.com/reports/4745813/fully-enclosed-3d-printing-smart-warehouse

Fully Enclosed 3D Printing Smart Warehouse - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/4745812/fully-enclosed-3d-printing-smart-warehouse

Global Fully Enclosed 3D Printing Smart Warehouse Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4745811/fully-enclosed-3d-printing-smart-warehouse

Global Fully Enclosed 3D Printing Smart Warehouse Market Insights, Forecast to 2031

https://www.qyresearch.com/reports/4745810/fully-enclosed-3d-printing-smart-warehouse

About Us

QYResearch founded in California, USA in 2007. It is a leading global market research and consulting company. With over 18 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 66,000 clients across five continents. Let’s work closely with you and build a bold and better future.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

EN: https://www.qyresearch.com

Email: global@qyresearch.com

Tel: 001-626-842-1666(US)

JP: https://www.qyresearch.co.jp

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.