Right Now

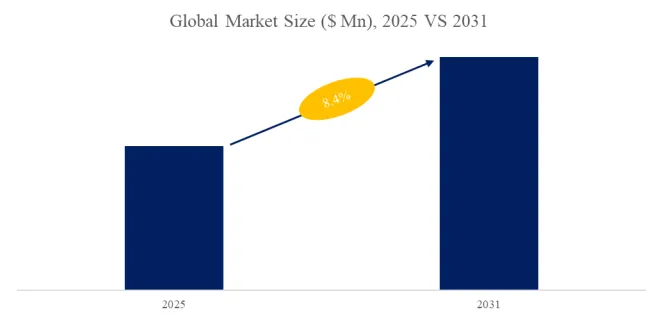

Automated X-ray Inspection (AXI) Research:CAGR of 8.4% during the forecast period

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report “Automated X-ray Inspection (AXI)- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”. Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2025-2031), this report provides a comprehensive analysis of the global Wire Drawing Dies market, including market size, share, demand, industry development status, and forecasts for the next few years.

The global market for Automated X-ray Inspection (AXI) was estimated to be worth US$ 643 million in 2024 and is forecast to a readjusted size of US$ 1107 million by 2031 with a CAGR of 8.2% during the forecast period 2025-2031.

【Get a free sample PDF of this report (Including Full TOC, List of Tables & Figures, Chart)】

https://www.qyresearch.com/reports/3435473/automated-x-ray-inspection--axi

Automated X-ray Inspection (AXI) Market Summary

X-ray inspection technology, commonly referred to as Automated X-ray inspection or Automated X-ray Inspection (AXI), is a technique used to examine hidden features of target objects or products that use X-rays as a source. Generally, there are manual x-ray inspection and automated X-ray inspection, we only focus on the Automated X-ray Inspection (AXI) market.

In the SMT industry, Automated X-ray inspection, or AXI, is a technology that uses X-rays to examine the features of a printed circuit board, semiconductor package, or power modules that are hidden from view and therefore cannot be captured by automated optical inspection (AOI), which uses visible light as its source.

X-ray inspection is also widely used in lots of applications such as medical, industrial control, and aerospace for control the quality of board assemblies and to analyze defects of hidden solder joints. X-ray has a unique advantage that is materials absorb X-rays proportional to their atomic weight and all materials absorb the X-ray radiation differently depending on their density, atomic number and thickness. Generally speaking, materials made of heavier elements absorb more X-rays and are easily imaged, while materials made of lighter elements are more transparent to X-rays.

At present, AXI technology has been widely used in product detection in lithium battery, semiconductor, solar photovoltaic, integrated circuit, electronic manufacturing, PCB, LED, die casting and other industries.

Market Drivers:

Increasing Demand for High-Quality and Reliable Electronics

Miniaturization of Electronics: As electronics continue to become smaller and more complex, traditional inspection methods are no longer sufficient. AXI can provide detailed images of micro-level defects such as voids, misalignments, and solder joint issues that would be difficult to detect visually, making it essential for ensuring product quality.

High-Performance Components: With the growing adoption of high-performance components like BGAs (Ball Grid Arrays), QFNs (Quad Flat No-leads), CSPs (Chip Scale Packages), and microelectronics, AXI technology is increasingly used to inspect these components for solder joint integrity, voiding, and bonding quality.

Growth of the Semiconductor and Electronics Industry

Semiconductor Packaging: With the demand for advanced semiconductors in smartphones, 5G networks, automotive, and other industries, semiconductor packaging has become more complex. AXI is essential for inspecting the integrity of wire bonds, solder joints, and packages, and ensuring the reliability of these components in critical applications.

Advanced PCB Assemblies: In the electronics sector, particularly for high-density interconnect (HDI) boards and flex PCBs, AXI provides the necessary inspection capabilities to ensure quality at every stage of assembly.

Demand for Higher Reliability in Automotive and Aerospace

Automotive Electronics: With the increasing integration of electronic systems in vehicles—especially in safety-critical areas like ADAS (Advanced Driver Assistance Systems) and electric vehicles (EVs)—AXI has become crucial in ensuring the reliability of automotive electronics. The high-precision inspection offered by AXI helps detect defects in the complex PCB assemblies, sensors, and powertrain components used in modern vehicles.

Aerospace and Defense: Similarly, aerospace and defense applications require the highest standards of reliability and performance. AXI systems are used to ensure that the electronic components used in critical systems, such as avionics and satellite communications, are free from internal defects that could cause failures.

Non-Destructive Testing (NDT) Trends

Increased Focus on Quality and Safety: As industries face higher standards for product quality and safety (especially in critical sectors like aerospace, medical devices, and automotive), the demand for non-destructive testing (NDT) methods like AXI has grown. AXI allows manufacturers to detect hidden defects without damaging the components, making it a preferred method for quality assurance.

Regulatory Pressure: Regulatory bodies are imposing stricter requirements on product safety and reliability, especially in sectors like medical devices and aerospace. This creates a strong incentive for manufacturers to adopt AXI systems to comply with industry standards and ensure high-quality products.

Increasing Complexity of Products and Assemblies

Multi-Layer Assemblies: The increasing use of multi-layer and stacked components in PCBs, smartphones, and consumer electronics is driving the adoption of AXI. As components become more densely packed and interconnected, it becomes more difficult to inspect them thoroughly using traditional methods. AXI offers the ability to inspect layers within assemblies, helping to detect internal faults such as solder voids, cracked components, and misaligned parts.

3D and 2.5D Packaging: The adoption of 3D IC packaging and 2.5D packaging requires high-resolution, non-destructive inspection methods, which AXI systems are ideally suited to provide. The ability to inspect through multiple layers and view the internal structures of complex packaging is essential for manufacturers of these advanced packages.

Market Challenges

Increasing Demand for High-Quality and Reliable Electronics

Miniaturization of Electronics: As electronics continue to become smaller and more complex, traditional inspection methods are no longer sufficient. AXI can provide detailed images of micro-level defects such as voids, misalignments, and solder joint issues that would be difficult to detect visually, making it essential for ensuring product quality.

High-Performance Components: With the growing adoption of high-performance components like BGAs (Ball Grid Arrays), QFNs (Quad Flat No-leads), CSPs (Chip Scale Packages), and microelectronics, AXI technology is increasingly used to inspect these components for solder joint integrity, voiding, and bonding quality.

Growth of the Semiconductor and Electronics Industry

Semiconductor Packaging: With the demand for advanced semiconductors in smartphones, 5G networks, automotive, and other industries, semiconductor packaging has become more complex. AXI is essential for inspecting the integrity of wire bonds, solder joints, and packages, and ensuring the reliability of these components in critical applications.

Advanced PCB Assemblies: In the electronics sector, particularly for high-density interconnect (HDI) boards and flex PCBs, AXI provides the necessary inspection capabilities to ensure quality at every stage of assembly.

Demand for Higher Reliability in Automotive and Aerospace

Automotive Electronics: With the increasing integration of electronic systems in vehicles—especially in safety-critical areas like ADAS (Advanced Driver Assistance Systems) and electric vehicles (EVs)—AXI has become crucial in ensuring the reliability of automotive electronics. The high-precision inspection offered by AXI helps detect defects in the complex PCB assemblies, sensors, and powertrain components used in modern vehicles.

Aerospace and Defense: Similarly, aerospace and defense applications require the highest standards of reliability and performance. AXI systems are used to ensure that the electronic components used in critical systems, such as avionics and satellite communications, are free from internal defects that could cause failures.

Non-Destructive Testing (NDT) Trends

Increased Focus on Quality and Safety: As industries face higher standards for product quality and safety (especially in critical sectors like aerospace, medical devices, and automotive), the demand for non-destructive testing (NDT) methods like AXI has grown. AXI allows manufacturers to detect hidden defects without damaging the components, making it a preferred method for quality assurance.

Regulatory Pressure: Regulatory bodies are imposing stricter requirements on product safety and reliability, especially in sectors like medical devices and aerospace. This creates a strong incentive for manufacturers to adopt AXI systems to comply with industry standards and ensure high-quality products.

Increasing Complexity of Products and Assemblies

Multi-Layer Assemblies: The increasing use of multi-layer and stacked components in PCBs, smartphones, and consumer electronics is driving the adoption of AXI. As components become more densely packed and interconnected, it becomes more difficult to inspect them thoroughly using traditional methods. AXI offers the ability to inspect layers within assemblies, helping to detect internal faults such as solder voids, cracked components, and misaligned parts.

3D and 2.5D Packaging: The adoption of 3D IC packaging and 2.5D packaging requires high-resolution, non-destructive inspection methods, which AXI systems are ideally suited to provide. The ability to inspect through multiple layers and view the internal structures of complex packaging is essential for manufacturers of these advanced packages.

According to the new market research report “Global Automated X-ray Inspection (AXI) Market Report 2025-2031”, published by QYResearch, the global Automated X-ray Inspection (AXI) market size is projected to reach USD 0.95 billion by 2031, at a CAGR of 8.4% during the forecast period.

Figure00001. Global Automated X-ray Inspection (AXI) Market Size (US$ Million), 2020-2031

Above data is based on report from QYResearch: Global Automated X-ray Inspection (AXI) Market Report 2025-2031 (published in 2024). If you need the latest data, plaese contact QYResearch.

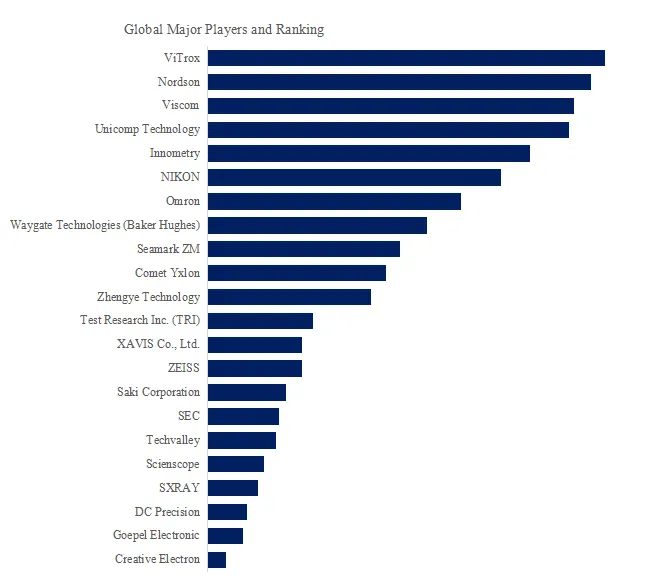

Figure00002. Global Automated X-ray Inspection (AXI) Top 22 Players Ranking and Market Share (Ranking is based on the revenue of 2024, continually updated)

Above data is based on report from QYResearch: Global Automated X-ray Inspection (AXI) Market Report 2025-2031 (published in 2024). If you need the latest data, plaese contact QYResearch.

According to QYResearch Top Players Research Center, the global key manufacturers of Automated X-ray Inspection (AXI) include ViTrox, Nordson, Viscom, Unicomp Technology, Innometry, NIKON, Omron, Waygate Technologies (Baker Hughes), Seamark ZM, Comet Yxlon, etc. In 2024, the global top five players had a share approximately 43.0% in terms of revenue.

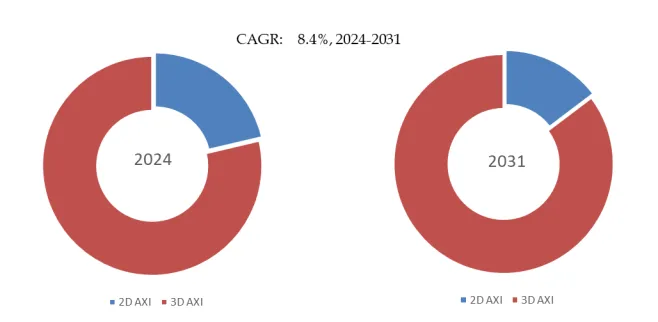

Figure00003. Automated X-ray Inspection (AXI), Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Automated X-ray Inspection (AXI) Market Report 2025-2031.

In terms of product type, currently 3D AXI is the largest segment, hold a share of 78.7%.

In terms of product application, currently PCB Industry is the largest segment, hold a share of 56.0%.

The report provides a detailed analysis of the market size, growth potential, and key trends for each segment. Through detailed analysis, industry players can identify profit opportunities, develop strategies for specific customer segments, and allocate resources effectively.

The Automated X-ray Inspection (AXI) market is segmented as below:

By Company

ViTrox Corporation

Omron

Nordson

Viscom

NIKON

Innometry

Comet Yxlon

Unicomp Technology

Zhengye Technology

Waygate Technologies (Baker Hughes)

Test Research Inc. (TRI)

DC Precision

Saki Corporation

ZEISS

Techvalley

SEC

Seamark ZM

Goepel Electronic

Scienscope

Segment by Type

2D AXI

3D AXI

Segment by Application

PCB Industry

Integrated Circuits

Battery Industry

LED & Casting

Others

Each chapter of the report provides detailed information for readers to further understand the Automated X-ray Inspection (AXI) market:

Chapter 1: Introduces the report scope of the Automated X-ray Inspection (AXI) report, global total market size (valve, volume and price). This chapter also provides the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry. (2020-2031)

Chapter 2: Detailed analysis of Automated X-ray Inspection (AXI) manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc. (2020-2025)

Chapter 3: Provides the analysis of various Automated X-ray Inspection (AXI) market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments. (2020-2031)

Chapter 4: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.(2020-2031)

Chapter 5: Sales, revenue of Automated X-ray Inspection (AXI) in regional level. It provides a quantitative analysis of the market size and development potential of each region and introduces the market development, future development prospects, market space, and market size of each country in the world..(2020-2031)

Chapter 6: Sales, revenue of Automated X-ray Inspection (AXI) in country level. It provides sigmate data by Type, and by Application for each country/region.(2020-2031)

Chapter 7: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc. (2020-2025)

Chapter 8: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 9: Conclusion.

Benefits of purchasing QYResearch report:

Competitive Analysis: QYResearch provides in-depth Automated X-ray Inspection (AXI) competitive analysis, including information on key company profiles, new entrants, acquisitions, mergers, large market shear, opportunities, and challenges. These analyses provide clients with a comprehensive understanding of market conditions and competitive dynamics, enabling them to develop effective market strategies and maintain their competitive edge.

Industry Analysis: QYResearch provides Automated X-ray Inspection (AXI) comprehensive industry data and trend analysis, including raw material analysis, market application analysis, product type analysis, market demand analysis, market supply analysis, downstream market analysis, and supply chain analysis.

and trend analysis. These analyses help clients understand the direction of industry development and make informed business decisions.

Market Size: QYResearch provides Automated X-ray Inspection (AXI) market size analysis, including capacity, production, sales, production value, price, cost, and profit analysis. This data helps clients understand market size and development potential, and is an important reference for business development.

Other relevant reports of QYResearch:

Global Automated X-ray Inspection (AXI) Market Size, Manufacturers, Supply Chain, Sales Channel and Clients, 2025-2031

Global Automated X-ray Inspection (AXI) Market Research Report 2025

SMT Automated X-ray Inspection (AXI)- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

Global SMT Automated X-ray Inspection (AXI) Market Research Report 2025

Automated X-Ray Inspection (AXI) Equipment for PCB Assembly- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

Global Automated X-Ray Inspection (AXI) Equipment for PCB Assembly Market Research Report 2025

Automated X-ray Inspection (AXI) - Global Market Share and Ranking, Overall Sales and Demand Forecast 2024-2030

Global SMT Automated X-ray Inspection (AXI) Market Insights, Forecast to 2030

SMT Automated X-ray Inspection (AXI) - Global Market Share and Ranking, Overall Sales and Demand Forecast 2024-2030

Global SMT Automated X-ray Inspection (AXI) Market Research Report 2024

Global Automated X-Ray Inspection (AXI) Equipment for PCB Assembly Market Research Report 2024

Automated X-ray Inspection (AXI) - Global Market Insights and Sales Trends 2024

Global Automated X-ray Inspection (AXI) Market Research Report 2023

Global Automated X-ray Inspection (AXI) Sales Market Report 2023

Global Automated X-ray Inspection (AXI) Industry Research Report, Growth Trends and Competitive Analysis 2023-2029

Global Automated X-ray Inspection (AXI) Market Report, History and Forecast 2018-2029, Breakdown Data by Manufacturers, Key Regions, Types and Application

Global Automated X-ray Inspection (AXI) Market Research Report 2024

SMT Automated X-ray Inspection (AXI) - Global Market Insights and Sales Trends 2024

Global SMT Automated X-ray Inspection (AXI) Market Research Report 2023

Global SMT Automated X-ray Inspection (AXI) Market Insights, Forecast to 2029

About Us:

QYResearch founded in California, USA in 2007, which is a leading global market research and consulting company. Our primary business include market research reports, custom reports, commissioned research, IPO consultancy, business plans, etc. With over 18 years of experience and a dedicated research team, we are well placed to provide useful information and data for your business, and we have established offices in 7 countries (include United States, Germany, Switzerland, Japan, Korea, China and India) and business partners in over 30 countries. We have provided industrial information services to more than 60,000 companies in over the world.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

EN: https://www.qyresearch.com

Email: global@qyresearch.com

Tel: 001-626-842-1666(US)

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.