Right Now

Non-Destructive Testing Service for Nuclear Research:CAGR of 7.6% during the forecast period

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report “Non-Destructive Testing Service for Nuclear Industry- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031”. Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2025-2031), this report provides a comprehensive analysis of the global Wire Drawing Dies market, including market size, share, demand, industry development status, and forecasts for the next few years.

The global market for Non-Destructive Testing Service for Nuclear Industry was estimated to be worth US$ 617 million in 2024 and is forecast to a readjusted size of US$ 1091 million by 2031 with a CAGR of 8.6% during the forecast period 2025-2031.

【Get a free sample PDF of this report (Including Full TOC, List of Tables & Figures, Chart)】

https://www.qyresearch.com/reports/4396149/non-destructive-testing-service-for-nuclear-industry

Non-Destructive Testing Service for Nuclear Industry Market Summary

Non-Destructive Testing (NDT) Service for the Nuclear Industry refers to a set of specialized techniques and methodologies employed to evaluate the integrity, structural soundness, and material properties of components, systems, and structures within the nuclear sector without causing any damage or alteration to the inspected items. These services leverage principles of physics such as radiation, sound waves, electromagnetic fields, and thermal imaging to detect internal flaws, cracks, corrosion, material degradation, or other anomalies that could compromise safety, performance, or compliance with regulatory standards. In the nuclear industry, NDT is critical for ensuring the reliability of critical infrastructure, including reactor vessels, piping systems, pressure boundaries, fuel assemblies, and containment structures, as well as for quality control during manufacturing, maintenance inspections, and decommissioning activities. The non-destructive nature of these tests allows for repeated evaluations over time, enabling proactive maintenance, extending the lifespan of equipment, and mitigating risks associated with potential failures in high-stakes nuclear environments.

According to the new market research report “Global Non-Destructive Testing Service for Nuclear Market Report 2024-2030”, published by QYResearch, the global Non-Destructive Testing Service for Nuclear market size is projected to reach USD 1.69 billion by 2030, at a CAGR of 7.6% during the forecast period.

Figure00001. Global Non-Destructive Testing Service for Nuclear Industry Market Size (US$ Million), 2019-2030

Above data is based on report from QYResearch: Global Non-Destructive Testing Service for Nuclear Industry Market Report 2024-2030 (published in 2024). If you need the latest data, plaese contact QYResearch.

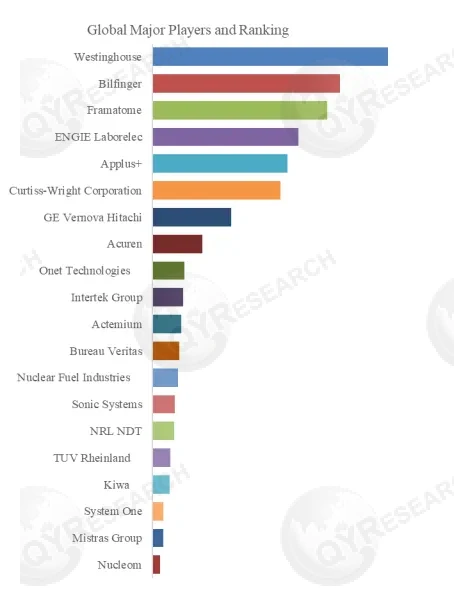

Figure00002. Global Non-Destructive Testing Service for Nuclear Industry Top 20 Players Ranking and Market Share (Ranking is based on the revenue of 2023, continually updated)

Above data is based on report from QYResearch: Global Non-Destructive Testing Service for Nuclear Industry Market Report 2024-2030 (published in 2024). If you need the latest data, plaese contact QYResearch.

According to QYResearch Top Players Research Center, the global key manufacturers of Non-Destructive Testing Service for Nuclear include Westinghouse, Bilfinger, Framatome, ENGIE Laborelec, Applus+, etc. In 2023, the global top five players had a share approximately 32.0% in terms of revenue.

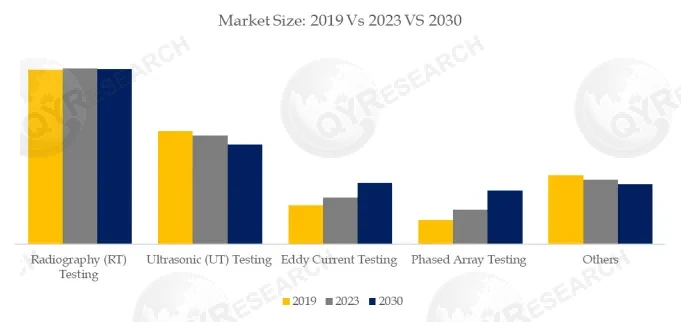

Figure00003. Non-Destructive Testing Service for Nuclear Industry, Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Non-Destructive Testing Service for Nuclear Industry Market Report 2024-2030.

In terms of product type, currently Radiography (RT) Testing is the largest segment, hold a share of 44.5%.

In terms of product application, currently Pressurized Water Reactor is the largest segment, hold a share of 79.6%.

Non-Destructive Testing Service for Nuclear Industry Market Trends

Deep Integration of AI and NDT

The application of AI technology in non-destructive testing in the nuclear industry has shown explosive growth.

Technology companies represented by Trueflaw offers industry leading AI analysis for automatic defect recognition. These systems are trained with a combination of client data and Trueflaw's virtual cracks to obtain human level performance. The detection systems are tailored for each customer and validated using POD – the gold standard of NDE reliability.

Increased Penetration of Intelligent and Automated Equipment

In the context of Industry 4.0, automated inspection equipment is replacing manual operations at an accelerated pace. In the inspection of key equipment such as steam generators and pressure vessels in nuclear power plants, automated scanning devices combined with phased array ultrasonic technology (PAUT) can achieve rapid defect location and quantitative analysis while reducing the risk of radiation exposure to personnel. In addition, the application of new inspection vehicles such as intelligent wall-climbing robots and drones has further expanded the inspection capabilities in complex environments.

Industry Concentration Increases

Top players are accelerating their globalization layout, and industry mergers and acquisitions will intensify. In addition, leading companies are accelerating the layout of full life cycle services, extending from single testing to equipment health management, and providing an integrated solution of "testing + maintenance + replacement".

Non-Destructive Testing Service for Nuclear Industry Market Restraints

R1: High Technical Barriers

Nuclear industry nondestructive testing equipment has strict requirements on sensor accuracy, transducer stability and environmental adaptability. In addition, the application of emerging technologies (such as terahertz imaging and laser ultrasound) in submillimeter defect detection is still in the development stage, and the lack of technical maturity has hindered market promotion.

R2: High Costs of Intelligent Transformation

The nuclear industry testing scenario has extremely high requirements for equipment stability and environmental adaptability, resulting in high costs for intelligent transformation. The imbalance in input-output ratio has restricted the willingness of small and medium-sized enterprises to transform into intelligent ones.

R3: Emerging Technologies Lack Unified Standards

The application of additive manufacturing (3D printing) in the fields of nuclear fuel cladding tubes, reactor structural parts, etc. has spawned new defect forms such as interlayer bonding defects and pore aggregation, but the existing inspection standards are still based on traditional forging and welding processes.

Non-Destructive Testing Service for Nuclear Industry Market Drivers

D1: Emerging Markets on the Rise

Emerging markets such as Southeast Asia, the Middle East, and India have become new engines of industry growth. Indonesia plans to introduce 250,000-kilowatt nuclear power units in the early 2030s. By 2050, more than 20 nuclear power units will be put into operation. Thailand is also exploring the introduction of SMRs. India plans to build 100 million kilowatts of nuclear power installed capacity by 2047. These new regions will bring new incremental markets for Non-Destructive Testing Service for Nuclear Industry.

D2: Collaborative Development of the Industrial Chain

The coordinated development of the industrial chain plays a core role in the driving factors of the nuclear industry non-destructive testing service market. It is specifically manifested in the following ways: upstream core components accelerate the promotion of independent control of the industrial chain; midstream equipment manufacturers and downstream nuclear power plants deeply collaborate through the "equipment + service" integrated model, and at the same time, through the joint construction of laboratories with NDT service providers, the AI algorithm is optimized to improve the defect detection rate; standard formulation and mutual recognition of certification mechanisms reduce market entry barriers. The construction of a localized service network responds to geopolitical risks. These collaborative practices not only solve the pain points of technology gaps and lack of standards, but also promote the evolution of the nuclear industry non-destructive testing service market towards high-end, intelligent, and globalization through resource integration and value co-creation.

D3: Nuclear Power Capacity Expansion and Decommissioning Demand Growth

The global nuclear power industry has entered a new round of expansion cycle, with China, India, Russia and other countries contributing the main growth. Their key equipment such as pressure vessels and steam generators need to undergo a comprehensive in-service inspection every 10 years. At the same time, the global nuclear facility decommissioning market has gradually started. For example, Germany plans to shut down all nuclear power plants by 2030. During the decommissioning process, high-precision inspections of reactor pressure vessels, containment and other structures are required, giving rise to a large number of non-destructive testing service needs.

The report provides a detailed analysis of the market size, growth potential, and key trends for each segment. Through detailed analysis, industry players can identify profit opportunities, develop strategies for specific customer segments, and allocate resources effectively.

The Non-Destructive Testing Service for Nuclear Industry market is segmented as below:

By Company

ENGIE Laborelec

Innerspec Technologies

International Atomic Energy Agency

NDT Group

OnestopNDT

NRL NDT

Zetec

Applus+

Tecnatom

Westinghouse Electric Company

Ionix

SGS

Salem NDT

TWI

Actemium

Nucleom

Omexom

Segment by Type

Dye Penetrant Testing

Magnetic Particle Testing

Eddy Current Testing

Phased Array Testing

Segment by Application

Nuclear Reactor

Nuclear Power Plant

Pipeline

Containment

Others

Each chapter of the report provides detailed information for readers to further understand the Non-Destructive Testing Service for Nuclear Industry market:

Chapter 1: Introduces the report scope of the Non-Destructive Testing Service for Nuclear Industry report, global total market size (valve, volume and price). This chapter also provides the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry. (2020-2031)

Chapter 2: Detailed analysis of Non-Destructive Testing Service for Nuclear Industry manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc. (2020-2025)

Chapter 3: Provides the analysis of various Non-Destructive Testing Service for Nuclear Industry market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments. (2020-2031)

Chapter 4: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.(2020-2031)

Chapter 5: Sales, revenue of Non-Destructive Testing Service for Nuclear Industry in regional level. It provides a quantitative analysis of the market size and development potential of each region and introduces the market development, future development prospects, market space, and market size of each country in the world..(2020-2031)

Chapter 6: Sales, revenue of Non-Destructive Testing Service for Nuclear Industry in country level. It provides sigmate data by Type, and by Application for each country/region.(2020-2031)

Chapter 7: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc. (2020-2025)

Chapter 8: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 9: Conclusion.

Benefits of purchasing QYResearch report:

Competitive Analysis: QYResearch provides in-depth Non-Destructive Testing Service for Nuclear Industry competitive analysis, including information on key company profiles, new entrants, acquisitions, mergers, large market shear, opportunities, and challenges. These analyses provide clients with a comprehensive understanding of market conditions and competitive dynamics, enabling them to develop effective market strategies and maintain their competitive edge.

Industry Analysis: QYResearch provides Non-Destructive Testing Service for Nuclear Industry comprehensive industry data and trend analysis, including raw material analysis, market application analysis, product type analysis, market demand analysis, market supply analysis, downstream market analysis, and supply chain analysis.

and trend analysis. These analyses help clients understand the direction of industry development and make informed business decisions.

Market Size: QYResearch provides Non-Destructive Testing Service for Nuclear Industry market size analysis, including capacity, production, sales, production value, price, cost, and profit analysis. This data helps clients understand market size and development potential, and is an important reference for business development.

Other relevant reports of QYResearch:

Global Non-Destructive Testing Service for Nuclear Industry Market Outlook, In‑Depth Analysis & Forecast to 2031

Non-Destructive Testing Service for Nuclear Industry - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

Global Non-Destructive Testing Service for Nuclear Industry Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

Global Non-Destructive Testing Service for Nuclear Industry Market Research Report 2025

Global Non-Destructive Testing Service for Nuclear Industry Market Insights, Forecast to 2031

About Us:

QYResearch founded in California, USA in 2007, which is a leading global market research and consulting company. Our primary business include market research reports, custom reports, commissioned research, IPO consultancy, business plans, etc. With over 18 years of experience and a dedicated research team, we are well placed to provide useful information and data for your business, and we have established offices in 7 countries (include United States, Germany, Switzerland, Japan, Korea, China and India) and business partners in over 30 countries. We have provided industrial information services to more than 60,000 companies in over the world.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

EN: https://www.qyresearch.com

Email: global@qyresearch.com

Tel: 001-626-842-1666(US)

JP: https://www.qyresearch.co.jp

More Posts

Report This Post

Please complete the following requested information to flag this post and report abuse, or offensive content. Your report will be reviewed within 24 hours. We will take appropriate action as described in Findit terms of use.